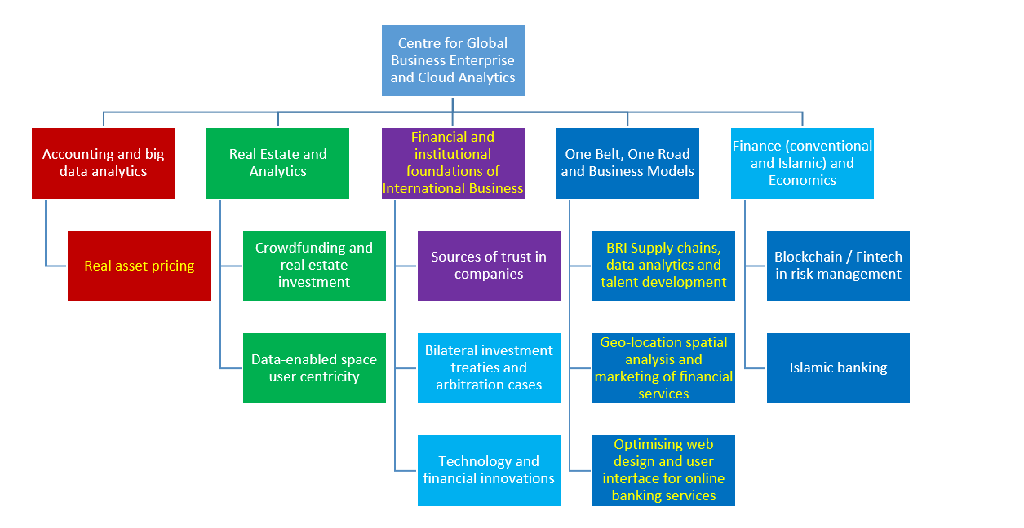

Figure 1: An overview of the centre research areas and current projects

Research Projects and/or Interests:

Integrating one belt, one road new supply chains

Eng, T.Y. and Yang, S.

The One belt, One road initiative or known as Belt Road Initiative (BRI) by China will transform global supply chain routes and business landscape. This research examines how the development of BRI affect and extend the Chinese supply chains and their implications for different host countries. By modeling the proposed new supply chains from the BRI the study examines potential economic implications. This includes developing an understanding about:

- Supply chain networks of BRI and socio-economic impact for local businesses. This involves modeling of new markets, distribution, and supply and demand for products and services.

- Technology application across supply chain services in terms of data analytics, digitisation and innovation for BRI.

- Human resource implications of BRI especially strategic human resource planning and technology deployment (e.g., artificial intelligence) and talent development to cope with future supply chains and BRI opportunities.

Retail banking: Challenges and evolutions in digital transformation

Krasonikolakis, I. and Eng, T.Y.

Digital banking through the use of websites and mobile applications (e.g., Monzo, Revolut) is changing the way nowadays banks interact with their customers. The use of digital technology in online media (platforms) provides instantaneous solutions to customers and businesses. In a five-year study (2013-2017) conducted for four major US banks with an international presence (Pramanik et al., 2019), the results show the dynamics of the field and the trends of the past that is current practice: (1) the number of mobile payments exceeds 3 billion every week, (2) a new and award-winning digital (mobile) bank platform attracted 5,500 new users daily, increasing eventually the number of users by 22 million, and (3) a bank of 40 million 'digital' customers has reduced transactions compared to the physical stores by 130 million and increased the electronic transactions by 180 million within two years.

Large multinational technology-focused companies have penetrated in the online payments sector, and new companies focusing on the provision of financial services are constantly emerging. FinTech already exert pressure both on the traditional banking sector, as well as on regulatory frameworks. In the USA, the legislative framework encourages the establishment of new banking architectures strengthening the continuous change in the development and provision of financial services (Berger, 2003). FinTech through real-time interaction with the customers can better understand their needs and react accordingly due to the simplification of their processes. FinTech has been "attacking" traditional banks with digital "weapons" by attracting their customers’ base. (CapGemini, 2016). This empirical research investigates a conglomerate of international banks on how new technologies transform the relationships of the Banks with the customers and other entities involved.

Financial technology and innovation

Nafis Alam, Yoke Yue Kan, Pisal Zainal

Research about role of technology in finance, banking and business to assess how financial institutions (FIs) are leveraging technological changes and improving the quality of financial services. This area of research brings together financial industry experts for dialogue and industry collaboration to discuss key issues and identify how to jointly address them. Some of the proposed research areas within the fintech and financial innovation will be:

- Understanding the role of Blockchain/ Fintech in Risk management

- How the combination of several innovations in different areas of financial services, from payments to investment services, will affect the microstructure of financial markets

- What are general perceptions of customers/investors when it comes to role of technology in Finance- Psychological implications

- What are the expectations of FIs from future finance graduates and if Universities are ready to deliver it

- Role of Roboadvisors and automation in Financial industry

- Use of bigdata and analytics in Financial services

Accounting analytics

Celis, E.E, Wu, C. and Chan, D..

Research in accounting and audit industry could leverage data analytics for the future outlook in accounting and assurance practice, such as financial reporting analysis and asset valuation. Streams of research in the interface of operations research and accounting analytics would benefit the industry by bringing collaboration with accounting professionals. Some of the proposed areas of research in accounting analytics include:

- Data analytics (predictive and prescriptive analytics) in shifting roles of accountants

- Application of big data in asset and financial instrument pricing

- How machine learning could be used in audit service

- Accounting information system under cloud computing

Real estate and analytics

Lecomte, P. Lee, J.H., Kee, K.L., and Lee, J.

New technologies are revolutionizing the way urban environment and buildings function and interact. Our research focuses on opportunities to develop knowledge and build context specific content in the fields of property management, real estate development and investment. For many years, real estate has been a spectator of technology, but things are changing fast for this tech-laggard sector as disruption is underway. Property and the built environment are indeed moving at the epicentre of a technology revolution.

Among the topics researchers affiliated to the Centre focus on are:

- Smart buildings and big data, especially in the context of Asean: opportunities for the real estate industry.

- Blockchain and smart contracting of real estate transactions: how can smart technology be applied in Asean countries to build transparent land registries, and keep track of property records, easements and deeds?

- Blockchain and smart contracting of real estate transactions: how can smart technology be applied in Asean countries to build transparent land registries, and keep track of property records, easements and deeds, thereby fostering property rights?

- Property management and smart technologies (e.g., IoTs, data analytics) with a focus on retail properties: maximizing yield for physical properties in the era of e-commerce. What do embedded technologies mean for developers, mall operators and retailers?

- Crowdfunding and real estate investments: this builds on the centre’s pro bono workshop which aims to help its participants identify new entrepreneurial start up opportunities.

- Data-enabled space user centricity in smart buildings, which accounts for space utilisation and productivity as well as space user experiences for a range of property types.